The post Ethereum (ETH) Will Soar 11% If This Key Trigger Hits appeared first on Coinpedia Fintech News

After consolidating for a week, Ethereum (ETH), the world’s second-largest cryptocurrency by market cap, is poised for massive upside momentum. On March 18, 2025, the overall cryptocurrency market has started witnessing a price surge once again. Amid this, ETH has reached the upper boundary of its consolidation and is on the verge of a breakout.

Ethereum (ETH) Technical Analysis and Upcoming Level

According to expert technical analysis, ETH has been consolidating in a tight range between $1,840 and $1,955 for the past week. However, today, as prices surge across the crypto market, the asset has reached the upper boundary of this range and is now a few points beyond the breakout.

Based on recent price action and historical momentum, if ETH breaches and closes a daily candle above the $1,960 level, there is a strong possibility it could soar by 11% to reach $2,200 in the coming days.

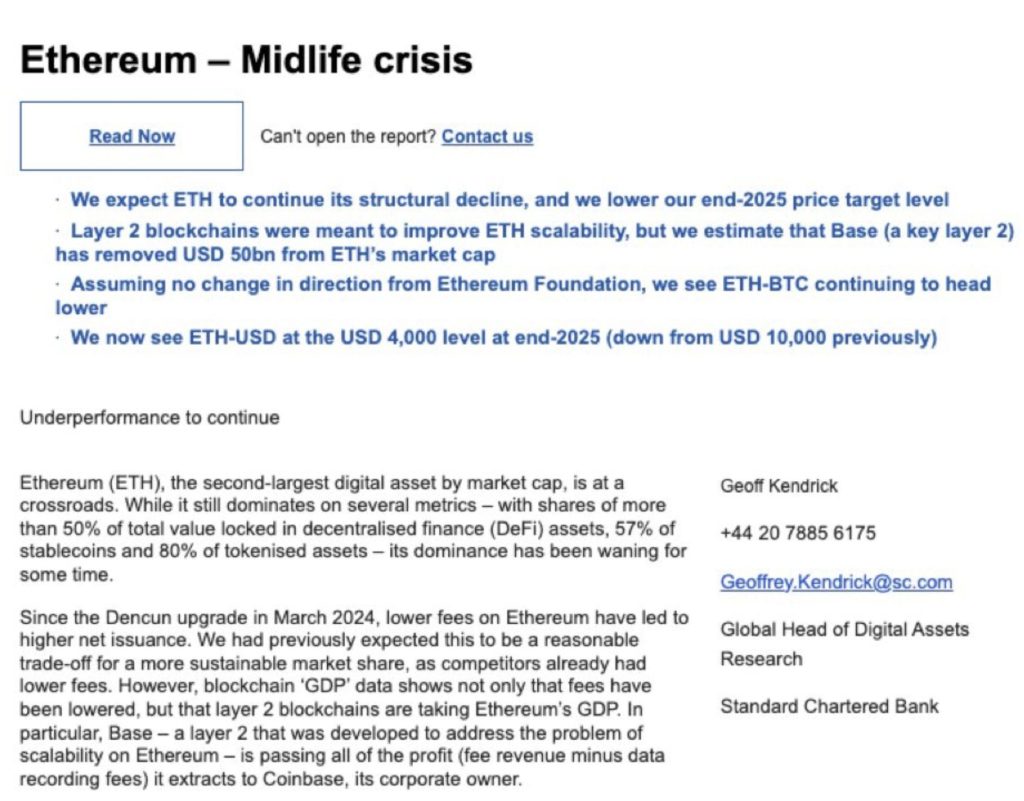

Amid the recent price drop, ETH has fallen significantly and is trading below the 200 Exponential Moving Average (EMA) on the daily timeframe, indicating that the asset is in a downtrend.

Bullish On-Chain Metrics

Despite ETH being in a downtrend, intraday traders appear bullish as they are strongly betting on the long side, according to the on-chain analytics firm Coinglass.

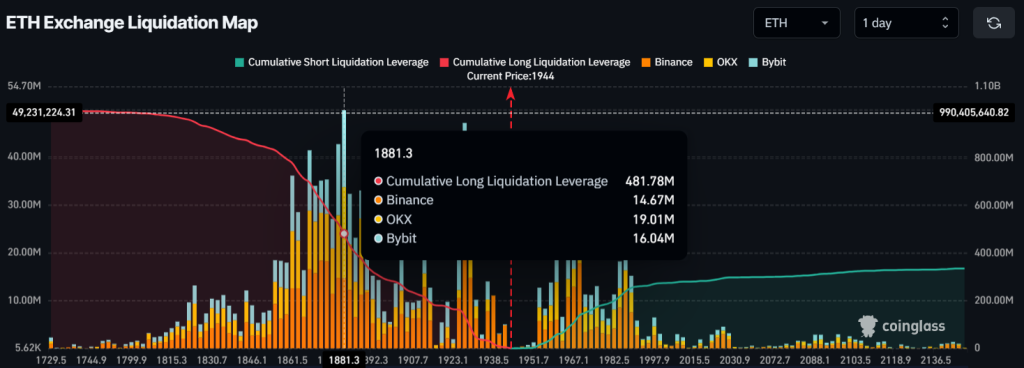

$480 Million Worth of Long Positions

Data reveals that traders are currently over-leveraged at $1,880 on the lower side, where they have built $480 million worth of long positions. Meanwhile, $1,970 is another over-leveraged level, with traders having built $140 million worth of ETH short positions, clearly indicating a bullish outlook among traders.

$50 Million Worth of ETH Outflow

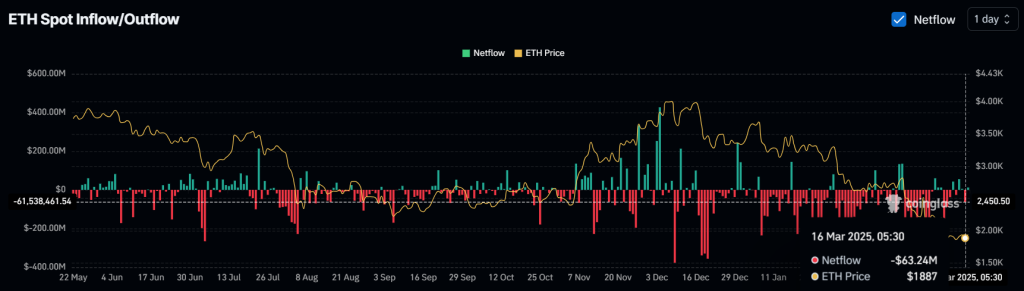

In addition to traders’ bullish outlook, investors and long-term holders also appear bullish in the long term, as they seem to be accumulating the asset and taking advantage of the recent price drop, according to the on-chain analytics firm CoinGlass.

Data from spot inflow/outflow reveals that exchanges have experienced nearly $50 million worth of ETH outflows in the past 48 hours, indicating potential accumulation and presenting an ideal example of a “buy the dip” opportunity.

Current Price Momentum

ETH is currently trading near $1,950 and has registered a 5% upside momentum in the past 24 hours. However, during the same time frame, due to its bullish outlook, it has witnessed significant participation from traders and investors, resulting in a 30% jump in trading volume.

There are prominent concerns about recovery, with sell-side pressure and weak momentum. Can ETH bounce back?

There are prominent concerns about recovery, with sell-side pressure and weak momentum. Can ETH bounce back?