The official Trump Coin (TRUMP), last near $11.50, remains stuck in an ominous short-term downtrend as the broader crypto market struggles.

Over the last month, TRUMP Coin has been continually printing lower highs and lower lows, suggesting the risk of a convincing break below $10 is rising.

Macro uncertainties, mainly around rising fears that the US economy might soon tilt into a recession, have weighed heavily on risk appetite in recent weeks.

Over the past month, Bitcoin has slipped from close to $100,000 to current levels in the low-$80,000s.

As for TRUMP Coin, things have continued to go from bad to worse. TRUMP is now down 85% from its post-launch January peak around $76.

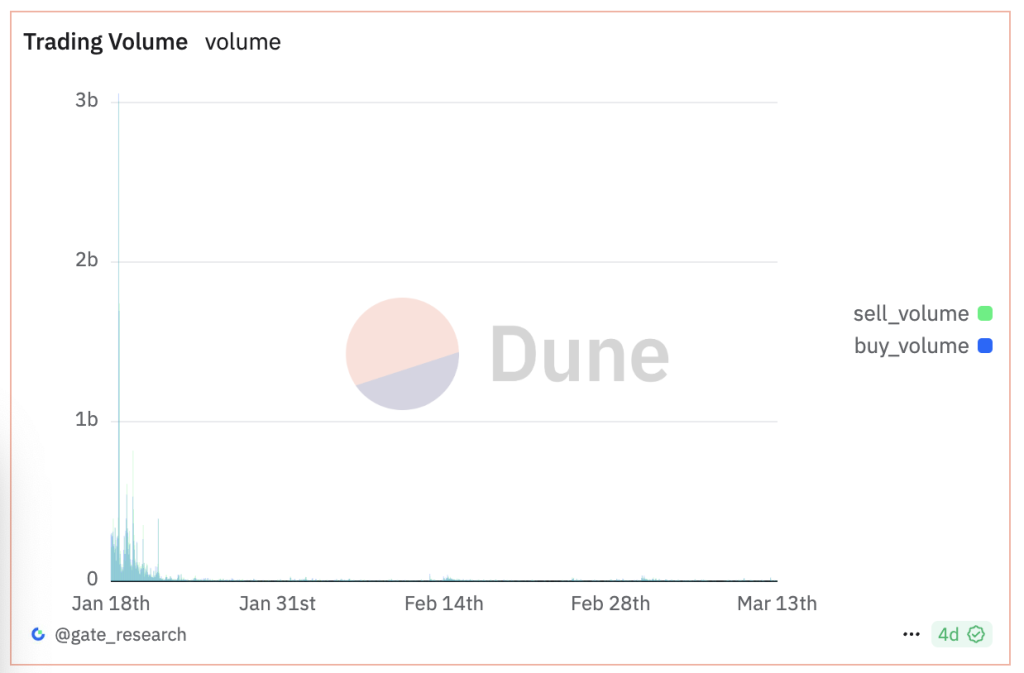

And on-chain metrics suggest a collapse in interest towards the meme coin. Per a Dune dashboard from gate_research, trading volumes have collapsed to a tiny percentage of the tens of billions in daily volume seen after TRUMP’s initial launch.

With activity having fallen so much since the initial launch, its no wonder the TRUMP coin price has collapsed so much.

And with macro uncertainties at risk of worsening in the coming weeks and months, the risk that the meme coin continues to shed value is high.

Should Traders Buy the Trump Coin Price Dip?

Assuming the current downtrend holds (an admittedly big assumption!), the TRUMP coin price could fall to around $6 by the middle of April.

Should traders buy a dip to such levels? Well, there are a few factors to consider. First, TRUMP coin has all the looks of having been a classic pump-and-dump.

A rapid initial rise that appeared to benefit and enrich insiders, followed by a massive price crash that left late-comers, of which there are many hundreds of thousands, massively out of pocket.

Its tough for any meme coin to recover from such an ugly start to life. TRUMP coin currently has over 650,000 holders, and presumably the vast majority are sitting on massive unrealized losses.

Its also worth noting the 80% of supply still held by Trump/insiders that will be sold off over the coming three years. That’s a lot of inflation.

So traders buying TRUMP coin should be aware of the risk that the meme coin never truly recovers and eventually goes to zero.

No one should risk more than they can afford to lose on TRUMP coin.

Can TRUMP Coin 10x?

That being said, the Trump brand is one of the most powerful in the world and will only rise over the course of his four-year term.

Its feasible to image a scenario where macro conditions improve, the Fed starts flooding the markets with liquidity again, and cryptos broadly experience a massive comeback.

TRUMP coin, given its narrative as THE coin of the US President, could do well in such an environment.

Perhaps it could even recover all the way back to its record highs and beyond. 10x gains from current levels should not be ruled out.

However, from a macro perspective, things are likely to get worse before they get better, so TRUMP coin holders shouldn’t hold their breath!

The post TRUMP Coin Set for Collapse to $6 – Buy the Dip? appeared first on Cryptonews.

The 6-hour chart illuminated that SHIB was trading under a local resistance at $0.0000138, a level that rebuffed the bulls on the 16th of March.

The 6-hour chart illuminated that SHIB was trading under a local resistance at $0.0000138, a level that rebuffed the bulls on the 16th of March.