The HLP whale continues to outmaneuver rivals with unexpected trades—masterful strategy or a ticking time bomb?

The HLP whale continues to outmaneuver rivals with unexpected trades—masterful strategy or a ticking time bomb?

Crypto ETPs Record $1.7 Billion Sell-Offs: CoinShares

Key Takeaways:

- Crypto ETPs saw notable withdrawals as market uncertainty alters investor strategies.

- Bitcoin experienced the largest pull while select digital assets attracted renewed interest.

- Early technical cues and institutional moves add a cautious angle to market shifts.

Cryptocurrency exchange-traded products (ETPs) saw outflows totaling $1.7 billion last week, as global investors continued pulling capital amid broader market declines, according to a March 17 CoinShares report.

Crypto ETPs Liquidation Streak Reaches $6.4 Billion Over Five Weeks

The latest report shows that the market downturn has triggered cumulative outflows of $6.4 billion over the past five weeks.

While last week’s outflows softened slightly to $876 million compared to prior weeks, the trend remains negative.

CoinShares’ Head of Research, James Butterfill, noted that the sell-offs have extended to 17 consecutive days, marking the longest outflow streak since CoinShares began tracking ETP flows in 2015.

Despite the prevailing bearish sentiment, year-to-date inflows remain positive at $912 million.

However, the sustained withdrawals have caused a major drop in total assets under management (AuM), which declined by $48 billion.

Bitcoin Leads Crypto ETP Sell-Offs, While XRP and Cardano Record Inflows

Bitcoin ETPs bore the brunt of the sell-off, with total outflows hitting $5.4 billion over the past five weeks.

This has nearly erased year-to-date inflows, which now stand at $612 million.

US-based ETFs led the sell-off, contributing $1.16 billion in outflows, which accounted for 93% of total weekly liquidations.

Switzerland also faced heavy selling pressure, with $528 million exiting due to a seed investor’s withdrawal. Meanwhile, Germany recorded a minor inflow of $8 million.

The broader decline in crypto ETPs was further reflected in Ethereum and Solana products, which posted outflows of $176 million and $2.2 million, respectively.

However, not all digital assets experienced declines. XRP and Cardano recorded positive flows, with XRP seeing $1.8 million in inflows and Cardano attracting a modest $400,000.

Market Sentiment Pressures Crypto ETPs, Bitcoin’s Technical Signals Suggest Possible Recovery

Unlike the previous CoinShares report, which cited factors such as the $1.4 billion Bybit hack and hawkish Federal Reserve comments as reasons for early March outflows, the latest report attributes the continued decline to broader negative market sentiment.

Technical indicators, however, suggest Bitcoin may be approaching a potential turning point.

Bitcoin’s stochastic RSI has printed a bullish cross, a setup that has historically preceded strong price rebounds.

Historically, Bitcoin has seen price recoveries averaging 55% within three to five months following such signals, with some rallies extending beyond 90%.

Meanwhile, institutional players have been adjusting their strategies amid the ongoing correction.

Data shows that global crypto hedge funds have increased their Bitcoin exposure, with accumulation levels rising to a four-month high.

Despite the current downturn in crypto ETPs, some institutional investors remain optimistic, anticipating a possible price recovery in the coming months.

Frequently Asked Questions (FAQs)

Investors pull funds from crypto ETPs amid market volatility and shifting regulations that drive a shift toward safer assets. Technical signals hint at a subtle change in risk appetite.

Technical indicators often mark subtle shifts in market trends, prompting investors to reconsider positions. These cues offer one view among factors that shape cautious moves.

Institutional players adjust portfolios amid market shifts. Their moves signal strategic shifts that shape trends and reflect cautious outlook in the digital asset space.

The post Crypto ETPs Record $1.7 Billion Sell-Offs: CoinShares appeared first on Cryptonews.

World Network Partners With Global Gaming Brand Razer, Reveals New Proof-of-Human Tech

World, the crypto project co-founded by OpenAI’s Sam Altman, has partnered with Razer, a major global lifestyle brand for gamers, revealing ‘Razer ID verified by World ID’.

According to the press release shared with Cryptonews, the collaboration aims to put “human gamers at the center of the AI gaming revolution.”

Gamers can use their Razer ID to create a World ID account and verify as human.

‘Razer ID verified by World ID’ is available in 22 countries, including Austria, Germany, Poland, Australia, Japan, South Korea, Singapore, Argentina, Mexico, the United States, and more.

The team explained that the ‘Razer ID verified by World ID’ is a novel single sign-on (SSO) proof-of-human technology. In short, it will verify real human gamers for Razer ID, proving that a person is behind every Razer ID account.

Furthermore, the unified SSO enables people to log into all services and software within the Razer ecosystem. This includes game payment services, a game booster, a unified cloud-based hardware configuration tool for full customizations, and a rewards program, the team said.

In turn, this will create “a safer, more authentic, and immersive environment for gamers worldwide.”

Additionally, it will give game developers a tool to build dynamic spaces for humans, not bots, and streamline player authentication for seamless logins.

Meanwhile, the new SSO’s first integration will be the TOKYO BEAST game. The human-verified accounts will highlight the project’s authenticity, said the announcement.

Notably, the tech aims to protect players from bots, scams, and misinformation. This is key given that the game allows NFT collection and in-game purchases through Razer Gold, a game payment service combining payment aggregation, wallet, webshop, and gift cards.

“World ID enables gamers to distinguish between authentic human interactions and AI-generated content, all while safeguarding their privacy,” commented Tiago Sada, Chief Product Officer at Tools for Humanity, a key contributor to World.

Gamers Want to Know if Their Competitor Is a Bot

The press release highlighted that AI-driven gaming is swiftly becoming the new normal.

“As AI continues to reshape the gaming world, we want to empower gamers and game developers with the tools they need to navigate this transformation safely and confidently,” said Wei-Pin Choo, Chief Corporate Officer of Razer.

To have fair competition and protect the human experience, “developers must be able to build trusted, human-only game experiences that keep AI bots out,” the exec said.

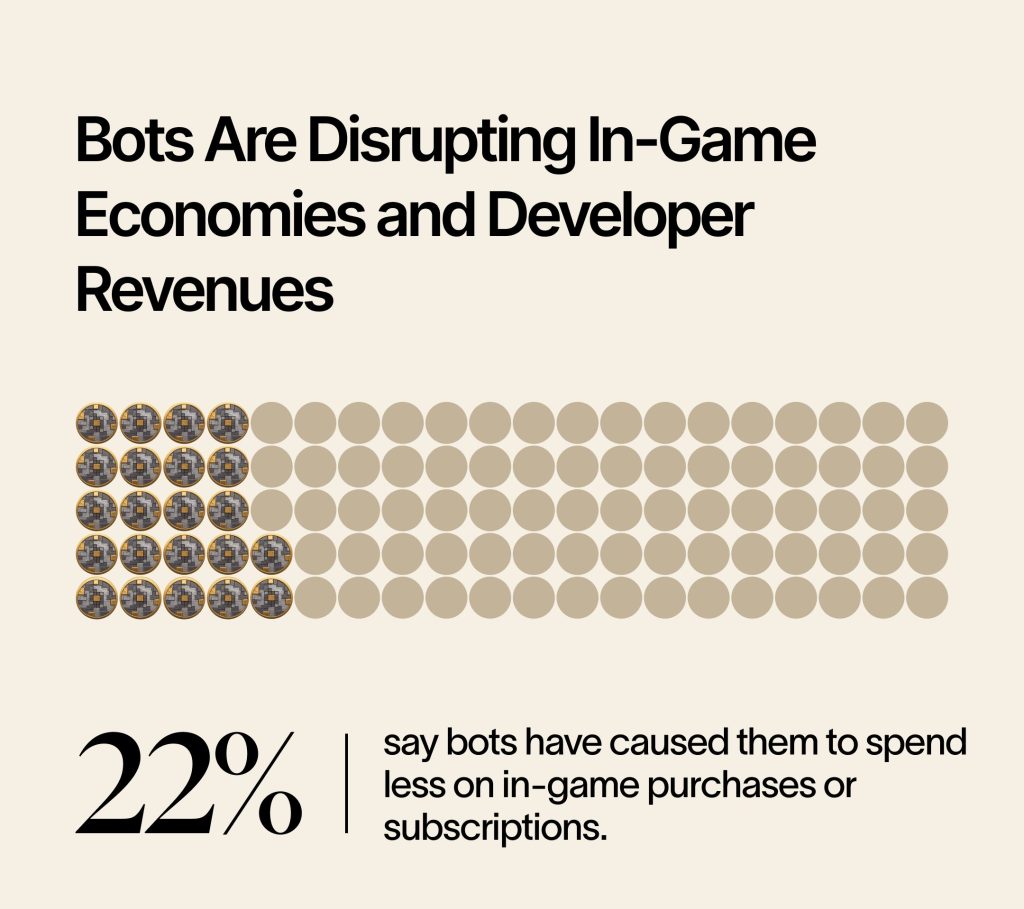

Meanwhile, Echelon Insights recently conducted a third-party survey of gamers, commissioned by Tools for Humanity. They found that gamers are running into external or unauthorized bots “somewhat often” and that these bots make the gaming experience “less fun and less fair.”

Also, 59% of the surveyed gamers reported that they regularly encounter unauthorized, third-party bots in games. Therefore, AI and bots are changing the gaming experience for players, the report concluded.

It explained that 59% of respondents say it is “extremely or very important to know whether they are competing against a bot or a real human in the game.”

Furthermore, 71% of gamers say bots are “ruining” multiplayer competition. 74% say they make it less fun to play certain games. Notably, 18% have stopped playing a game entirely in response to bots.

Therefore, 77% of gamers, across generational demographics, agree its relevant to prove humanity online. Also, 75% of gamers who play more than 10 hours per week want online gaming platforms to use biometric technology to verify humans.

The team noted that ‘Razer ID verified by World ID’ solves all these issues for gamers and developers, delivering more value to both.

The post World Network Partners With Global Gaming Brand Razer, Reveals New Proof-of-Human Tech appeared first on Cryptonews.