作者: Kevin, the Researcher at Movemaker

对比Move语言、Aptos与其他公链在技术上的差异,可能因观察深度不同而显得枯燥。笼统分析难免隔靴搔痒,深入代码又容易只见树木不见森林。要快速、准确地理解Aptos与其他公链的区别,选择一个合适的锚点至关重要。

笔者认为,一笔交易的生命周期是最佳切入点。通过分析交易从创建到最终状态更新的完整步骤——包括创建与发起、广播、排序、执行和状态更新——可以清晰把握公链的设计思路与技术取舍。以此为基准,向后退一步,能理解不同公链的核心叙事;向前进一步,则可探索如何在Aptos上打造吸引市场的应用。

如下图,所有区块链交易都围绕这五个步骤展开,而本文将以Aptos为中心,剖析其独特设计,并对比以太坊与Solana的关键差异。

Aptos:乐观并行与高性能设计

Aptos是一条强调高性能的公链,其交易生命周期与以太坊类似,但通过独特的乐观并行执行和内存池优化实现了显著提升。以下是Aptos上交易生命周期的关键步骤:

创建与发起

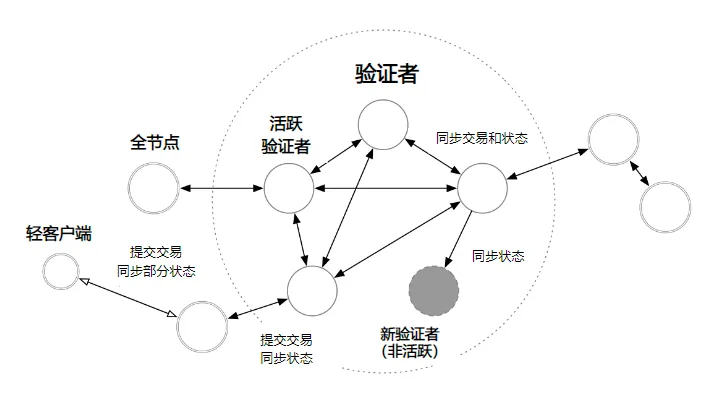

Aptos网络由轻节点、全节点和验证者组成。用户通过轻节点(如钱包或应用)发起交易,轻节点将交易转发给附近的全节点,全节点再同步至验证者。

广播

Aptos保留了内存池,不过在QuorumStore之后内存池之间不共享。与以太坊不同不同的是,其内存池不仅仅是交易缓冲区。在交易进入内存池后,系统根据规则(如FIFO或Gas费用)进行预排序,确保后续并行执行时交易无冲突。这种设计避免了Solana需提前声明读写集合的高硬件需求。

排序

Aptos采用AptosBFT共识,提议者原则上无法自由排序交易,aip-68赋予提议者额外填充被延迟交易的权利。内存池预排序已提前完成冲突规避,区块生成更依赖验证者间的协作,而非提议者主导。

执行

Aptos使用Block-STM技术实现乐观并行执行。交易被假设无冲突并同时处理,若执行后发现冲突,受影响的交易会被重新执行。这种方式利用多核处理器提升效率,TPS可达160,000。

状态更新

验证者同步状态,最终性通过检查点确认,类似于以太坊的Epoch机制,但效率更高。

Aptos的核心优势在于乐观并行与内存池预排序的结合,既降低了节点性能需求,又大幅提升了吞吐量。如下图所示,Aptos的网络架构清晰支持这一设计:

来源:Aptos白皮书

以太坊:串行执行的基准

以太坊作为智能合约的开创者,是公链技术的原点,其交易生命周期为理解Aptos提供基础框架。

以太坊交易生命周期

-

创建与发起:用户通过钱包经中继网关或RPC接口发起交易。

-

广播:交易进入公共内存池,等待打包。

-

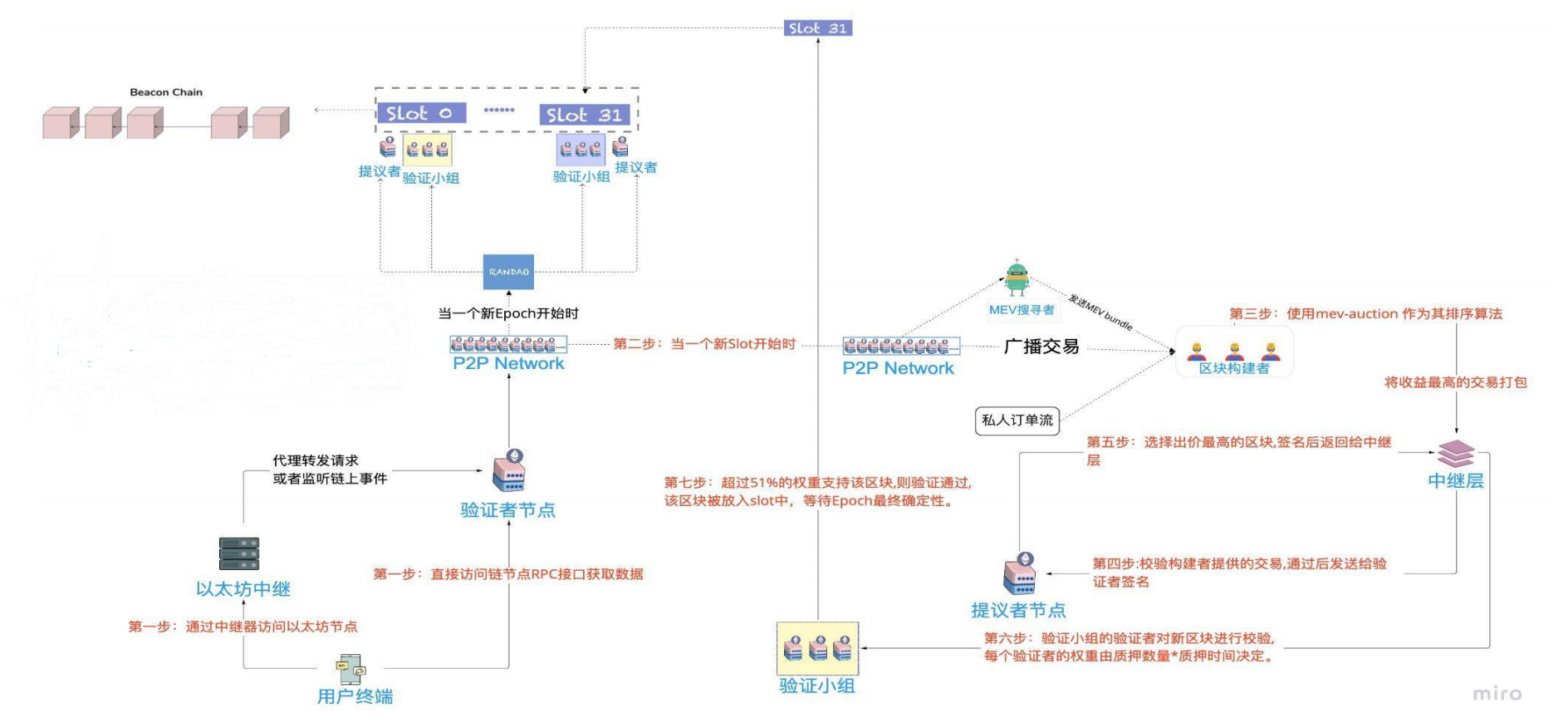

排序:PoS升级后,区块构建者按利润最大化原则打包交易,中继层竞标后提交给提议者。

-

执行:EVM串行处理交易,单线程更新状态。

-

状态更新:区块需通过两个检查点确认最终性。

以太坊的串行执行和内存池设计限制了性能,区块时间为12秒/插槽,TPS较低。相比之下,Aptos通过并行执行和内存池优化实现了质的飞跃。

Solana:确定性并行的极致优化

Solana以高性能著称,其交易生命周期与Aptos差异显著,尤其在内存池和执行方式上。

Solana交易生命周期

-

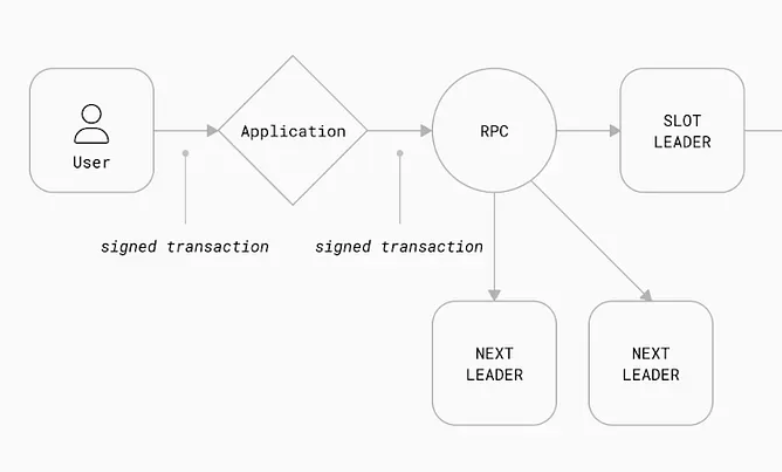

创建与发起:用户通过钱包发起交易。

-

广播:无公共内存池,交易直接发送给当前及下两位提议者。

-

排序:提议者基于PoH(Proof of History)打包区块,区块时间仅400毫秒。

-

执行:Sealevel虚拟机采用确定性并行执行,需提前声明读写集合以避免冲突。

-

状态更新:BFT共识快速确认。

Solana不使用内存池的原因是内存池可能成为性能瓶颈。由于没有内存池,以及Solana独特的PoH共识,节点能够快速达成交易顺序共识,避免了交易在内存池中排队的需要,交易几乎可以即时成交。然而,这也意味着在网络过载时,交易可能被丢弃而非等待,用户需重新提交。

相比之下,Aptos的乐观并行无需声明读写集合,节点门槛更低,TPS却更高。

来源:shoal research

并行执行的两种路径:Aptos vs Solana

交易的执行代表区块状态的更新,是交易发起指令转化为具有最终性状态的过程。这一变化如何理解?节点假设交易成功,计算其对网络状态的影响,这个计算过程就是执行。

因此,区块链中的并行执行指的是多核处理器同时计算网络状态的过程。在当前市场中,并行执行分为确定性并行执行和乐观并行执行两种方式。这两种开发方向的差异根源在于如何确保并行交易不发生冲突——即交易之间是否存在依赖关系。

由此可见,在交易生命周期中,确定并行交易依赖项冲突的时机——决定了确定性并行执行与乐观并行执行两种开发方向的分化,Aptos与Solana选择了不同方向:

-

确定性并行(Solana):交易广播前需声明读写集合,Sealevel引擎根据声明并行处理无冲突交易,冲突交易串行执行。优点是高效,缺点是硬件需求高。

-

乐观并行(Aptos):假设交易无冲突,Block-STM并行执行后验证,若有冲突则重试。内存池预排序降低冲突风险,节点负担更轻。

举例:账户A余额100,交易1转70给B,交易2转50给C。Solana通过声明提前确认冲突,按序处理;Aptos并行执行后若发现余额不足,重新调整。Aptos的灵活性使其更具扩展性。

乐观并行通过内存池来提前完成冲突确认

乐观并行的核心思想是假设并行处理的交易不会冲突,因此在交易执行前,应用端无需提交交易声明。若交易执行后验证时发现冲突,Block-STM会重新执行受影响的交易以确保一致性。

然而在实践中,若不提前确认交易依赖项是否冲突,真实执行时可能出现大量报错,导致公链运行卡顿。因此,乐观并行并非单纯假设交易无冲突,而是在某一阶段提前规避了风险,这个阶段就是交易广播阶段。

在Aptos上,交易进入公共内存池后,会根据一定规则(如FIFO和Gas费用高低)进行预排序,确保一个区块内的交易在并行执行时不会冲突。由此可见,Aptos的提议者实际上不具备交易排序能力,网络中也不存在区块构建者。这种交易预排序是Aptos实现乐观并行的关键。与Solana需引入交易声明不同,Aptos无需此机制,因此对节点性能的要求大幅降低。在确保交易不冲突的网络开销上,Aptos加入内存池对TPS的影响远小于Solana引入交易声明的代价。因此,Aptos的TPS可达160,000,超过Solana一倍以上。 交易预排序的影响是Aptos上捕获MEV的难度加大,这对用户而言利弊兼存,此处不再赘述。

基于安全性的叙事是Aptos的发展方向

-

RWA: Aptos正在积极推进现实资产代币化和机构金融解决方案。相比以太坊,Aptos的Block-STM能并行处理多笔资产转移交易,避免因网络拥堵导致的确权延迟。在Solana或者Sui上,尽管交易速度快,但无内存池设计可能在网络过载时丢弃交易,影响RWA的确权稳定性。Aptos的内存池预排序则确保交易按序进入执行,即使高峰期也能维持资产记录的可靠性。RWA需要复杂的智能合约支持,如资产分割、收益分配和合规性检查。Move语言的模块化设计和安全性,让开发者能更轻松地构建可靠的RWA应用。相比之下,以太坊Solidity的复杂性和漏洞风险增加了开发成本,而Solana的Rust编程虽高效,却对开发者学习曲线要求较高。Aptos的生态友好性有望吸引更多RWA项目落地,形成正向循环。Aptos在RWA领域的潜力在于安全性和性能的结合。未来,其可聚焦于与传统金融机构合作,将债券、股票等高价值资产上链,借助Move语言打造合规性强的代币化标准。这种“安全+高效”的叙事,能让Aptos在RWA市场中脱颖而出。

-

2024年7月,Aptos官宣将Ondo Finance的USDY引入生态,并于主要的DEX、借贷应用集成,截止3月10日,USDY在Aptos上的市值约为1500万美元,约占USDY总市值的2.5%。2024年10月,Aptos 宣布富兰克林邓普顿已在 Aptos Network 上推出以 BENJI 代币为代表的富兰克林链上美国政府货币基金(FOBXX)。此外,Aptos 与 Libre 合作推进证券代币化,将 Brevan Howard、BlackRock 和 Hamilton Lane 的投资基金上链,增强机构投资者访问。

-

稳定币支付:稳定币支付需要确保交易的最终性和资产安全。Aptos的Move语言通过资源模型防止双重支付,确保每一笔稳定币转账的准确性。例如,用户使用Aptos上的USDC支付时,交易状态更新受到严格保护,避免因合约漏洞导致资金丢失。此外,Aptos的低Gas费用(得益于高TPS分摊成本)使其在小额支付场景中极具竞争力。以太坊的高Gas费用限制了其支付应用,而Solana虽成本低,但网络过载时的交易丢弃风险可能影响用户体验。Aptos的内存池预排序和Block-STM则保证了支付交易的稳定性和低延迟。

-

PayFi和稳定币支付需兼顾去中心化与监管合规。AptosBFT的去中心化共识降低了中心化风险,同时其模块化架构支持开发者嵌入KYC/AML检查。例如,一个稳定币发行商可在Aptos上部署合规合约,确保交易符合本地法规,而不牺牲网络效率。这一点优于以太坊的中心化中继模式,也弥补了Solana提议者主导的潜在合规短板。Aptos的平衡设计使其更适合金融机构入场。

-

Aptos在PayFi和稳定币支付领域的潜力在于“安全、高效、合规”的三位一体。未来,会持续推动稳定币的大规模采用,打造跨境支付网络,或与支付巨头合作开发链上结算系统。高TPS和低成本还能支持微支付场景,如内容创作者的实时打赏。Aptos的叙事可聚焦于“下一代支付基础设施”,吸引企业和用户双向流量。

Aptos在安全性上的优势——内存池预排序、Block-STM、AptosBFT和Move语言——不仅提升了抗攻击能力,还为RWA和PayFi叙事奠定了坚实基础。在RWA领域,其高安全性和吞吐量支持资产代币化和大规模交易;在PayFi与稳定币支付中,低成本和高效性推动了现实应用落地。相比以太坊的稳健但低效、Solana的高速但高门槛,Aptos以平衡之道开辟新局。未来,Aptos可凭借这些优势,塑造“安全驱动的价值网络”叙事,成为连接传统经济与区块链的桥梁。

总结:Aptos 的技术差异与未来叙事

通过交易生命周期的视角,我们得以清晰对比 Aptos 与以太坊、Solana 和 Sui 在技术设计上的差异,并揭示其各自的核心叙事。以下表格总结了四者在广播、排序和执行阶段的异同,Aptos 的独特优势也由此凸显:

Aptos 的设计在性能与安全之间取得了巧妙平衡。其内存池预排序结合 Block-STM 的乐观并行,既降低了节点门槛,又实现了 160,000 TPS 的高吞吐量,超越 Solana 的确定性并行和 Sui 的对象级并行。与以太坊的串行执行相比,Aptos 的并行能力带来质的飞跃;而相较于 Solana 和 Sui 砍掉内存池的激进优化,Aptos 保留预排序机制,确保了网络在高负载下的稳定性。这种“稳中求快”的思路,辅以 Move 语言的资源模型,赋予 Aptos 更高的安全性——无论是抵御DDoS攻击,还是防止合约漏洞,都优于以太坊的传统架构和 Solana 的高硬件依赖。 与同样基于 Move 语言的 Sui 相比,Aptos 和 Sui 的分化更具启发性。Sui 以对象为中心,通过 DAG 排序和对象级并行追求极致性能,适合高并发资产管理场景;而 Aptos 以账户为中心,依托内存池和乐观并行,兼顾通用性与生态兼容性。这种差异不仅反映了技术路径的选择,也预示了应用方向的分化:Sui 或更擅长复杂资产操作,Aptos 则在安全性驱动的场景中占据优势。 正是基于这种安全性与性能的结合,Aptos 在RWA和PayFi叙事中展现出巨大潜力。在 RWA 领域,Aptos 的高吞吐量支持大规模资产上链,近期与 Ondo Finance(USDY 市值约 1500 万美元)、Franklin Templeton及 Libre的合作已初见成效。在 PayFi 和稳定币支付中,Aptos 的低成本、高效率和合规性支持微支付与跨境结算,成为“下一代支付基础设施”的有力候选。

综上,Aptos 在交易生命周期的每个环节都融入了安全与高效的考量,区别于以太坊的稳健低效、Solana 的高性能高门槛,以及 Sui 的对象驱动极致优化。未来,Aptos 可凭借“安全驱动的价值网络”叙事,连接传统金融与区块链生态,在 RWA 和 PayFi 领域持续发力,构建一个兼具信任与扩展性的公链新格局。